Southeast Asia (SEA) is home to four of seven of the world’s highest-performing emerging economies: Indonesia, Malaysia, Singapore, and Thailand.

According to McKinsey: GDP per capita for these countries has grown at least 3.5 per cent per annum since 1965. More recently (since 2000) we should include Vietnam and Myanmar to this list with an average GDP per capita growth of seven per cent and over the past eight years, the Philippines has also exceeded the yearly GDP growth per capita by 3.5 per cent.

The population of SEA consists out of roughly 600 million people. SEA has more than 360 million internet users. Out of which a 100 million internet users were added in just the last four years.

Venture capital activity

According to Temasek the region will have 10 new companies valued at over US$1 billion each by 2024. The internet economy in SEA will reach US$100 billion in 2019 and triple to US$300 billion by 2025.

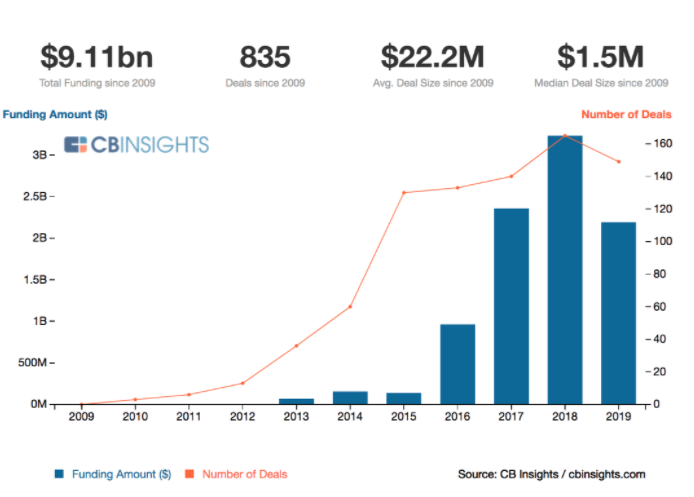

Fundraising backed by venture capitalists, private equity funds, and corporate investors is reaching record levels in SEA.

Also Read: Angel investing is full of risks –but that is why it is so rewarding

What kind of opportunities should an angel expect?

US-based VCs tend to back a lot of breakthrough innovation and transformational technologies and experiment with new business models.

Venture investing in SEA tends to focus on companies with technology and solutions that are already proven in developed markets, with the required adjustments to grow in a developing market with different demographics.

The Future

SEA is now in a golden era for tech startup growth as people’s livelihoods improve. In 2018, the average per capita income of SEA countries reached US$4,600, similar to that of China in 2007 when the country started its tech boom.

Covid-19

Another essential feature of these emerging countries has been their ability to achieve macroeconomic stability, even at a time of global volatility, by adapting policies to fit their local context and changing conditions. For example, governments took quick action to ensure rapid recovery from volatile episodes, such as the Asian financial crisis of the late 1990s and the global financial crisis of 2008 and 2009.

Even though COVID-19 is not a financial crisis we can expect SEA to recover faster than other regions.

SEA vs. Europe and the US?

Investors are looking towards the East to find value and diversify their portfolio:

- Europe is facing a lot of internal issues such as Brexit and Southern European countries on the verge of bankruptcy (even though the internal regulations of the European Union, in theory, make for an amazing market, they have not fully overcome their immense cultural differences)

- The US has just ended a long cycle of recovery and expansion, which has been underpinned by record-low interest rates and tax cuts

Also Read: Report: SEA digital investment climate to become more diverse, “strong” growth in most deal sizes

Growth of the middle class

As mentioned, millions of households are starting to earn higher incomes and moving into the middle class, which means increasing demand for consumer products and services.

The population is young, productive, and growing. Also, the SEA market is immature and there’s room to boost efficiency. Both conditions are helpful for value creation.

Global tensions and safe havens

As friction mounts among major trading countries, especially between China and the US, the emerging markets of SEA are increasingly seen as a safe haven for global investors and new avenues to seek diversification.

Industries

Driven by consumer needs, more and more startups are reaching unicorn status. SEA is one of the fastest-growing consumer markets in the region and increasingly natural addition to the global investor’s portfolio.

Alongside consumer-related industries, the latest data shows that investors are also drawn to the emerging segments of technology such as mobile payments, smart cities, and e-commerce in the region.

It’s difficult though to generalise about the attractiveness of industries on a regional basis. One has to look at individual countries to identify opportunities.

The nations individually have a diverse set of structural capabilities, natural resources, and labour skills. Singapore has emerged as a financial and legal powerhouse that offers easy access to investor capital and a well-established legal system known for its rule of law.

Countries such as Indonesia have extensive natural resources in a variety of sectors, while Vietnam, Myanmar, and Cambodia still maintain attractive labour markets.

Also Read: Angel investing is full of risks –but that is why it is so rewarding

Cross-border growth

Cross-border growth opportunities are yet to be fully exploited in SEA and should be one of the prime areas for an angel to look at. Companies that successfully crack the cross-border code have direct access to one of the largest economies in the world.

There are few regional champions that are strong across multiple SEA geographies. This is due to challenges faced with raising capital to grow a business into different cultures, work with different regulations and languages.

However, on January 1, 2016, the Association of Southeast Asian Nations (ASEAN), inaugurated the ASEAN Economic Community (AEC). The AEC aims to create a single market and production base for the free flow of goods, services, investment, capital, and skilled labour within ASEAN.

Cross-border development and efficiency gaps continually threaten AEC goals (because, for example, of fears of brain drain or a race to the bottom), and cross-cultural and political differences have proven irreconcilable with the consensus building.

However, as the AEC continues to mature, opportunities will arise for companies looking to expand in or into the Southeast Asian market and foreign direct investment is one of the publicly-stated priorities for the AEC.

Bottom-up research

And so even though investors should view SEA as one focus region it is important to analyse bottom-up and look for industries in specific countries that have the potential to grow cross-border and not top-down where one might miss country-specific problems (a mistake commonly made by foreign investors and founders that seem to think: ‘if it works in country A, I can also easily scale in country B’).

Deeper due diligence & longer investment horizons

For angels looking to invest in SEA, there are layers of complexities: the varying levels of development between countries, differing legal systems, and multiple languages and cultures.

Also Read: What should you consider before becoming an angel investor?

Hence, a deeper level of due diligence is required to navigate the intricacies of the region.

Also, due to the fact that the investment ecosystem is still less developed compared to the US and Europe, angels might have to accept a longer investment horizon (10 to 15 years) than they might be used to in developed markets (three to eight years), however, one can benefit from a potentially higher IRR as the region is emerging fast.

Ingredients for success

Scaling in SEA

Many successful (traditional) businesses have scaled successfully across the region. As long as one applies the right bottom-up methods and embraces the different cultures and regulations, there are no scaling barriers in SEA.

Follow-on capital

There is a consistent growth in the number of early stage companies and new VC funds, yet the amount of capital in early stage funds is not growing as much as more VCs prefer bigger and later stages.

Hence VCs are competing for the outflow of new companies funded by angel investors while this investable void (the space between ‘family & friends’ and VC capital) for angel investors remains large.

Sufficient talent

Finding talent is always a challenge. There’s currently simply more economic growth than talent. The upside is that the expansion in the region attracts a lot of foreign talent that is willing to start new businesses.

Either tech talent from India or successful founders from Europe or the US.

Opportunities for exits

Most exit opportunities are realised through M&A. There have been few large IPOs (Razer and game company SEA). As the region continues to attract more VC capital more and more PE funds will enter to seize later stage opportunities.

–

Register for our next webinar: Is your startup ready for the new normal?

Editor’s note: e27 aims to foster thought leadership by publishing contributions from the community. Become a thought leader in the community and share your opinions or ideas and earn a byline by submitting a post.

Join our e27 Telegram group, or like the e27 Facebook page

Image Credit: Aniq Danial on Unsplash

The post Why Southeast Asia is great for your angel investments appeared first on e27.