Just 1 per cent blockchain adoption is expected. What about the other 99 per cent?

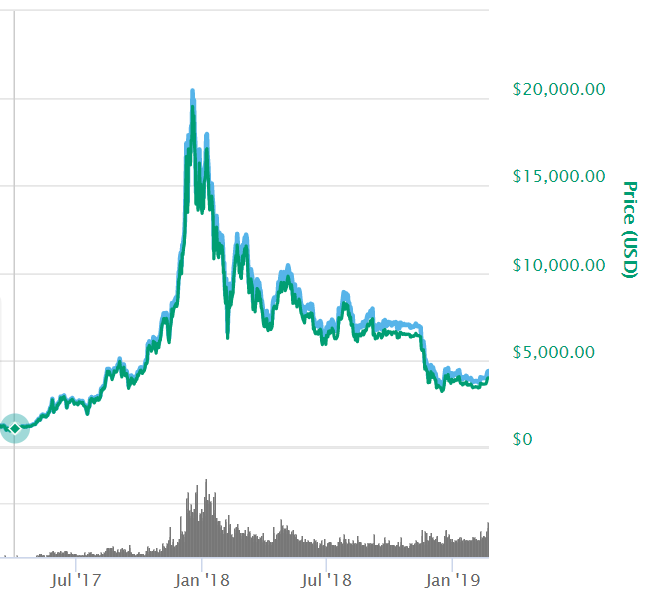

Bitcoin’s 2017 bull run from US$900 to US$20,000 (at its peak) has caught the world’s attention, bringing the once obscure distributed ledger technology mainstream.

Many industry newcomers have the misconception that blockchain is a newly emerged technology. However, the fact is that cryptocurrencies and the underlying blockchain technology have been around since a decade ago, back when Satoshi Nakamoto first published the Bitcoin Whitepaper in 2008 and mined the genesis block of bitcoin a year later.

The hype and attention buoyed by the parabolic price action have also attracted more players to enter the industry.

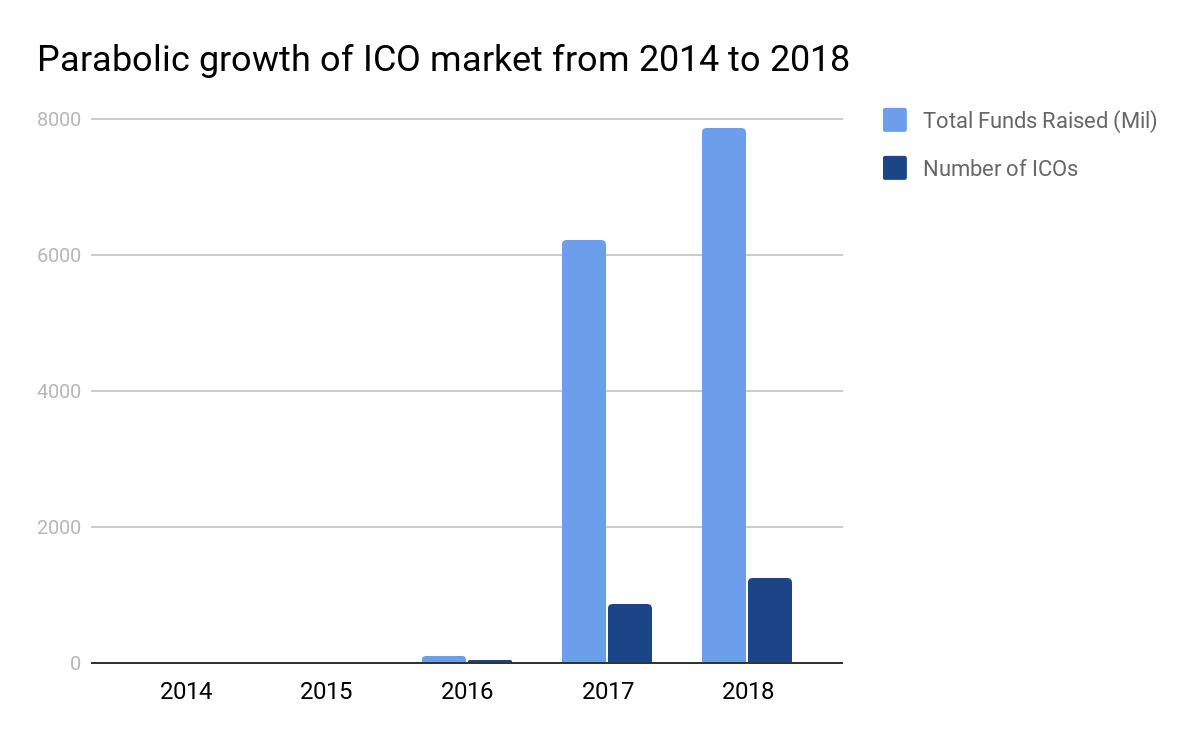

Just three years ago, the total number of ICOs stood at 29, with total funds raised totalling US$90 million. In comparison, the total number of ICOs in 2018 stood at 1,257 and total funds raised US$7,852 million — which translates to a whopping 4,234 per cent and 8,624 per cent growth respectively!

Source: ICOData.io

Despite being around for so long, and having garnered positive news and directions, blockchain technology remains far from practical adoption.

A 2018 survey by Gartner has indicated that blockchain adoption rates are still low — one per cent today and only eight per cent expected by surveyed CIOs in the short term.

Meanwhile, user adoption of decentralised applications (dApps) on Ethereum, the second largest cryptocurrency by market cap, remains surprisingly low. Daily users of all dApps averaged less than 10,000.

Yet, Ethereum has a multi-billion dollar market valuation at US$14 billion, highlighting that the prices of these cryptocurrencies are mostly driven by speculation and not use.

Also Read: Today’s top tech news, March 27: Indian student housing startup Stanza Living raises US$4.4M funding

So what exactly is holding blockchain technology back from mainstream adoption? We explore a few possible factors in this article.

Scalability of technology

Current technology limitations — such as scalability — remain a significant issue facing blockchain technology.

The scalability trilemma as termed by Ethereum’s founder Vitalik Buterin states that blockchain systems can only effectively possess two out of three components — either decentralisation, scalability or security hence trade-offs are almost inevitable.

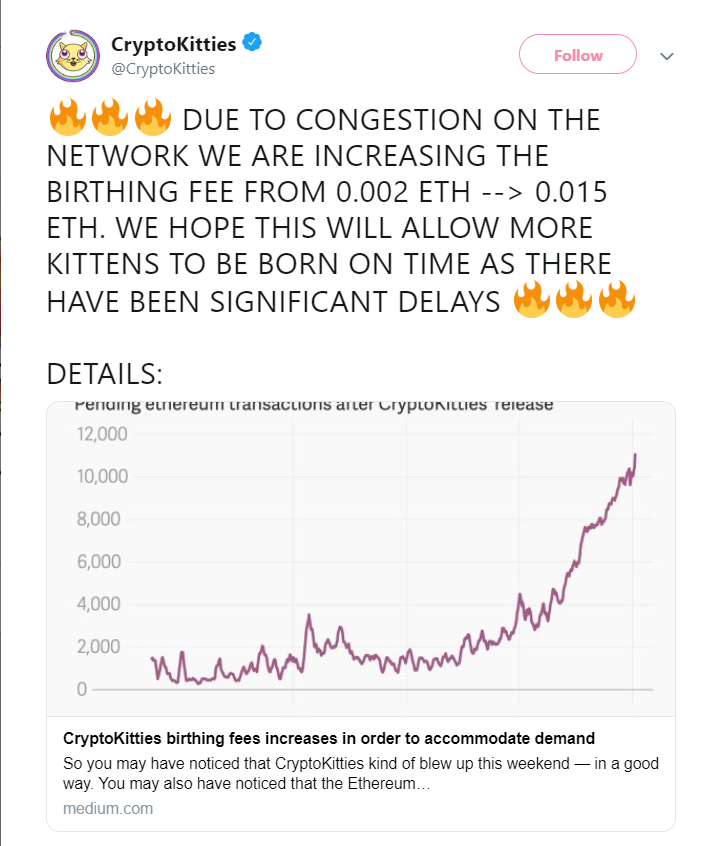

CryptoKitties, a ERC20 dApp enabling players to buy and breed digital kittens on the Ethereum network is a prime example highlighting current technical limitations of blockchain technology. This single dApp alone has resulted in the congestion of the entire ethereum network, highlighting the difficulties in scalability with decentralisation.

In December 2017, unprocessed ethereum transactions were reported to rise up six-folds resulting in Cryptokitties having to increase their “birthing” (transaction) fees to minimise network congestion.

It is promising to note that improvements to current technological limitations are actively being explored, such as the recent Ethereum Constantinople hard fork and new structures like the Directed Acyclic Graph (DAG) aiming to solve current limitations with blockchain technology.

Expectations outpacing usefulness

The state of ICOs draws parallel to the infamous Fyre Festival saga, with charismatic millennial founders over-promising and under-delivering by “selling a dream”.

The “80 per cent marketing, 20 per cent product” framework seems to ring true for many projects, with a recent E&Y report showing that only 29 per cent of 2017 ICOs have delivered a product.

Hence, it is important for investors and the public to do their own due diligence while assessing any opportunities. Reverse ICOs, ICOs founded by already established businesses with a proven team, communities and use cases may just prove to be an effective filter.

Lack of trust in a trustless system

Public sentiment and perception of the industry have been low, especially with the current bear market and bad actors in the industry.

In recent news, we have investors being locked out of US$190m after the death of an exchange founder, exchanges with 9.4 per cent of its total holdings stolen and a 20 per cent spike in money laundering cases in Japan last year.

It is no wonder that there is currently a lack of trust in the system, with regulatory and security issues being frequent occurrences.

Misconceptions fuelled by lack of education

Understandably, it has been tough for investors and the public to really get to know what cryptocurrencies and blockchain technology are all about, with the technical jargons and the ever-evolving landscape.

This has led to common misconceptions such as:

1. Bitcoin = cryptocurrencies = blockchain technology

Bitcoin, cryptocurrencies and blockchain technology are not interchangeable terms. Bitcoin is a form of cryptocurrency, while cryptocurrencies are forms of digital assets as mediums of exchange.

Blockchain technology is a form of distributed ledger, a technology underlying cryptocurrencies enabling peer-to-peer transactions.

2. Blockchain technology is only for cryptocurrencies and payment

Blockchain and cryptocurrencies may go like peanut butter and jelly. However, it is not the only use case for blockchain, a distributed ledger technology that spans across multiple industries and used cases.

Also Read: Paving the journey for our app users is a rocky road

3. Price volatility and bear market reflect the current state of technological progress

Blockchain technology, as the underlying distributed ledger technology, should not be conflated with the incentive layer of public blockchains, namely cryptocurrencies. As Apple co-founder Steve Wozniak shared in a CoinTelegraph interview, people should focus on Bitcoin value creation rather than being preoccupied with price.

No moonbois or lambos but the future remains bright

Despite such factors, holding the adoption of blockchain technology back, we still believe in the vast potential of blockchain technology, with its ability to impact and improve different industries.

According to a recent report from US-based market research firm International Data Corporation (IDC), global blockchain spending will account for almost US$2.9 billion in 2019, which is an 88.7 per cent increase from 2018.

With such positive projected growth and the involvement of big corporates and institutions — such as NYSE which recently launched digital assets platform Bakkt and corporates such as IBM’s well-known active involvement in blockchain technology — there’s still long-term growth and opportunities for the industry.

In order for the industry to mature and grow, we believe that education is key.

Investors, projects, users and the wider communities should look past the hype and instead learn more about the true state and merits of blockchain technology and explore how it could be used to solve problems or enhance existing solutions in different industries.

In time and with solid development, trust will slowly be built up.

—

Image Credits: maxuser

Disclaimer: Nothing written, posted or said by representatives of ArcadierX, its community managers, or community members should be interpreted as, taken as, or constitutes investment advice. All written comments are opinions of individuals and any investment is a risk that individuals take themselves.

ArcadierX is a leading marketplace builder Arcadier’s blockchain initiative to onboard users with a blockchain enhanced platform. For more insights and developments about blockchain and eCommerce, check us out on medium.

How can we expedite the rate of blockchain tech adoption? Continue the discussion with us on Telegram.

The post What’s holding blockchain back from mainstream adoption? appeared first on e27.